The Next-Gen Payments

Platform

By leveraging a composable architecture, Frame Banking™ places the transaction at the center of the financial experience and reduces the traditional limitations of legacy systems.

Frame Banking™ enables the intuitive, simple, and agile deployment of financial services across dierent channels in a scalable manner.

Innovation in Business Models

New Business Models based on transactions, such as collection, embedded finance, channel- dependent cash management, payment method, payment dynamics, etc

Multi-System Integrations with high-customization, seamless and without development, allowing multiple payments and collections in a single transaction.

Safe and Secure Transactions enabling the generation and autonomous control of transactional OTPs

Different Use Cases Remittances, international transfers, payment of services, P2P (peer-to-peer), cash in-out at correspondents, mass payments, interoperability.

Seamless Ecosystem Creation

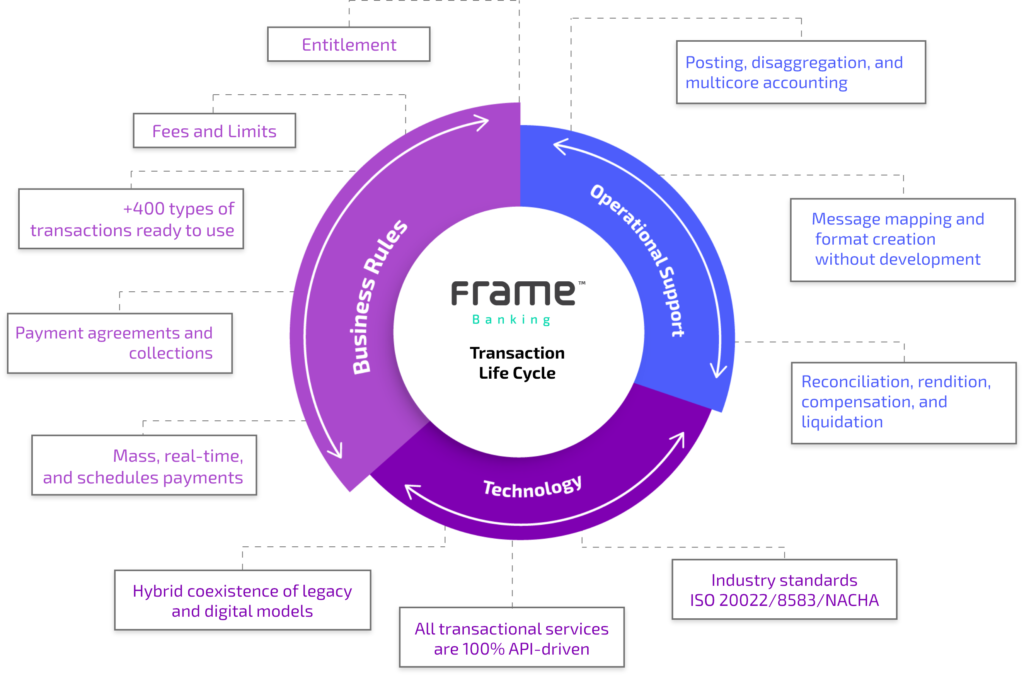

Integrations with multiple business channels inside and outside industry standards: ISO8583, ISO20022, NACHA, REST, SOAP, etc.

Easy, fast, and safe connections with all industry-related elements: certificates, TLS, VPN, etc.

Business Rules and Enrollment: Auto-enrollment, Validations, Agreements, Commissions, Taxes, Reconciliations, and Compensations

Sample Ecosystem Integrations with business partners, central banks, ACH (automated clearing house), correspondents, enterprises, and fintech companies

Efficiency Through Convergence

Frame Banking™ enables institutions to realize substantial savings in both cost and time. It facilitates the deployment of multiple use cases by converging different payment rails onto a single platform under one contract, optimizing resources to maximize operational efficiency.

Frame Banking™ replaces developments in the core to solve transactional logic; business rules and operational developments in integration pieces such as Service Bus, BPM, and API Gateways; reconciliation systems developed or ad hoc; and multiple solutions for each payment rail (remittances, SWIFT, Correspondents, Payment of services, etc.).

Frame Banking™ enables a payment rails convergence strategy with a single SaaS platform.

Frame Banking™ allows a multicore strategy, simplifying the role of various digital and legacy cores, and mitigating historical risks of banking core replacements.

A Composable Architecture Built for Change

• Centered on product and accounting

• Limited growth with no scaling capabilities

• Transactions as a “necessary evil”

• Evolution based on developer updates

• Vendor lock-in

• High-cost integrations

• Composable architecture based on APIs.

• Integration with new business models

• Faster time-to-market for products and services

• Centered on transactions and services

• No vendor lock-in

• Future-proof scalability

Trusted by Organizations Around the Globe

Next-Gen Transaction

Management and Monitoring

Frame Banking™ Key Principles and Advantages

Low Code

Customization & Scalability

Omnichannel Integrations

Cloud-Native SaaS

Transactions-Centered System

Core Agnostic

Powering the Full Life Cycle of Digital Transactions

Frame Banking™ Business Frameworks

Thrive in the next generation

of payment ecosystems

Unlock more responsive, agile, and engaging

transactions with Frame Banking™.

Unlock more responsive, agile, and engaging

transactions with Frame Banking™.